How ConsolidateAI Works

A complete walkthrough of the application screens and features

Dashboard — Command Center

The dashboard provides an instant overview of your consolidation status. See all entities at a glance, track pending eliminations, and monitor the health of your group structure. PKR is set as the default currency with multi-currency support.

Group Structure — Define Your Entities

Visually define your corporate group structure. Add the parent company and all subsidiaries with their ownership percentages and operating currencies. The hierarchy is displayed as an interactive organization chart.

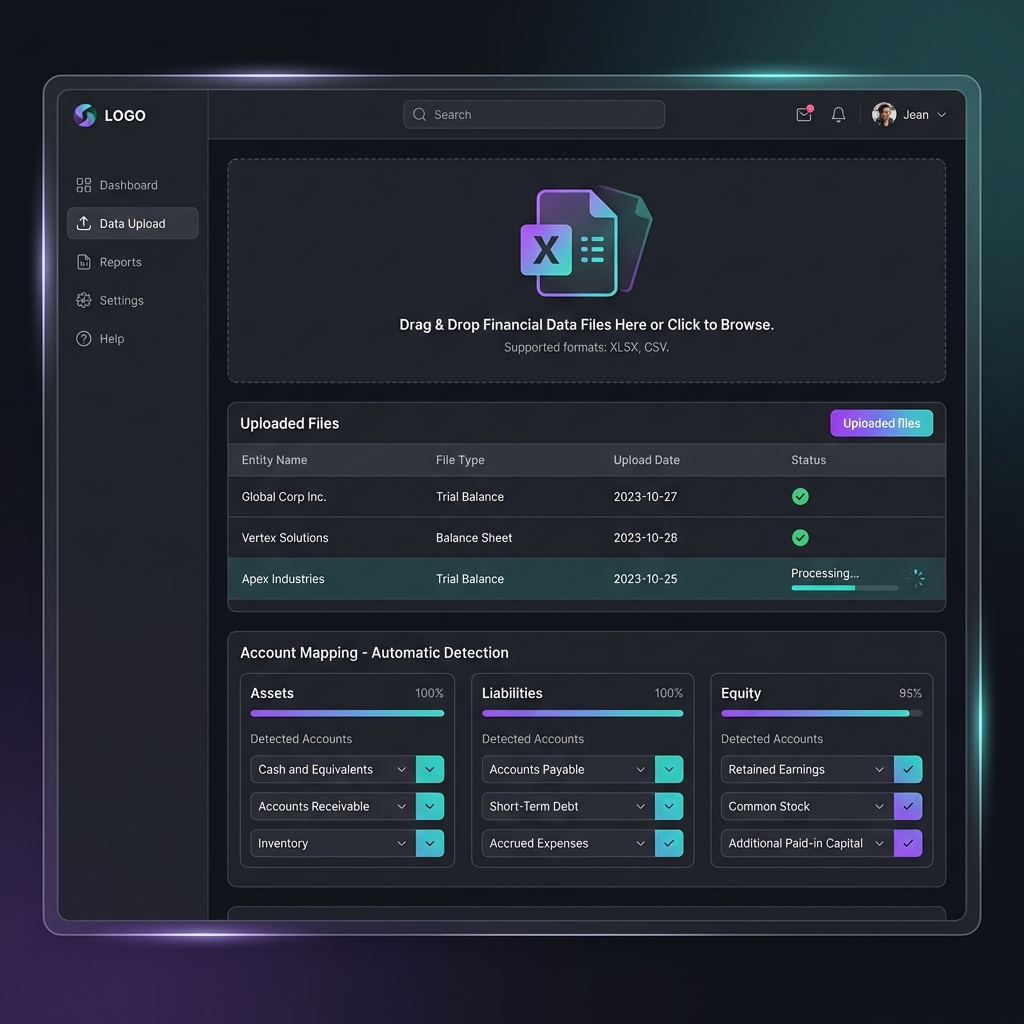

Financial Data Upload — Smart Import

Upload Excel files (XLSX, CSV) containing trial balances, balance sheets, or P&L statements. The system automatically detects and maps accounts to standard consolidation categories (Assets, Liabilities, Equity, Revenue, Expenses).

Intercompany Transactions — Easy Entry

Record all intercompany transactions (sales, loans, dividends) between group entities. The system automatically generates the correct elimination entries with one click.

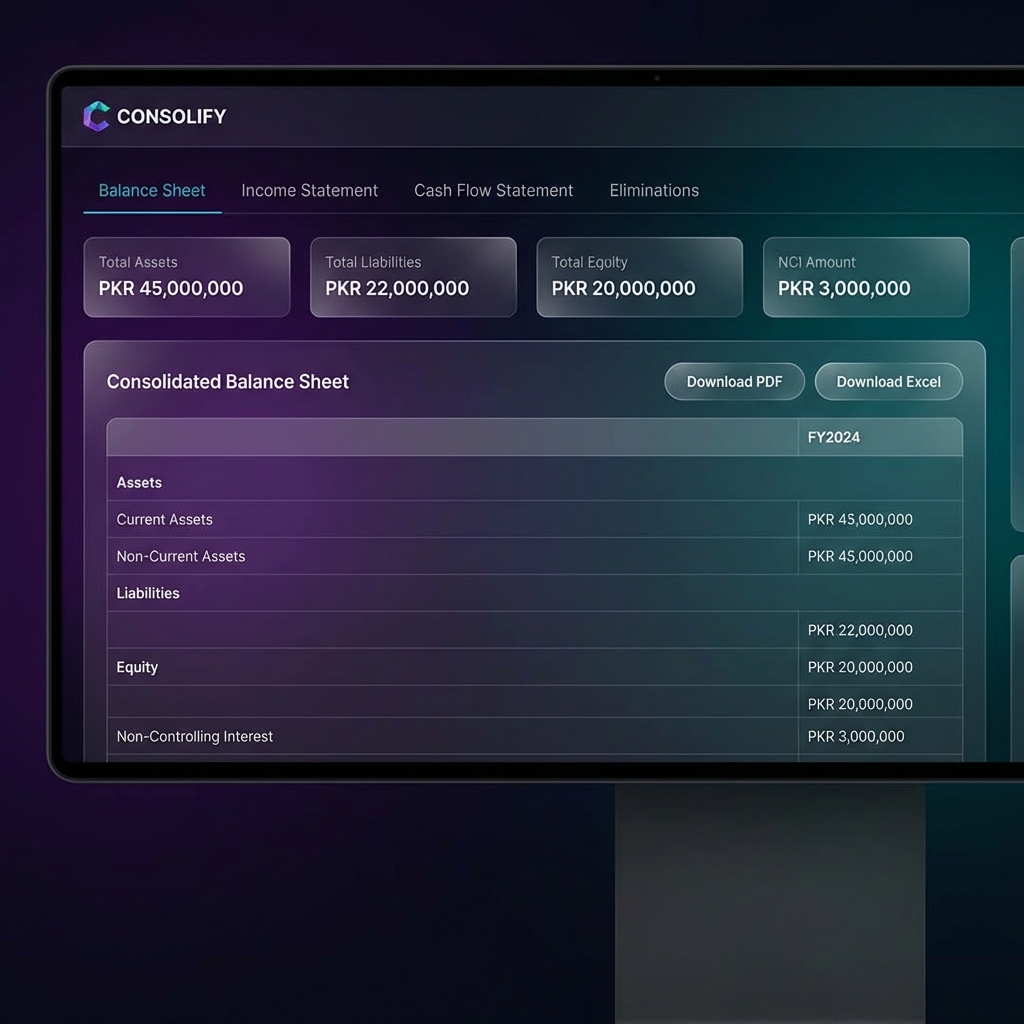

Consolidated Financial Statements

View the complete consolidated financial statements with all eliminations applied. Export to PDF or Excel with professional formatting. NCI (Non-Controlling Interest) is calculated automatically.

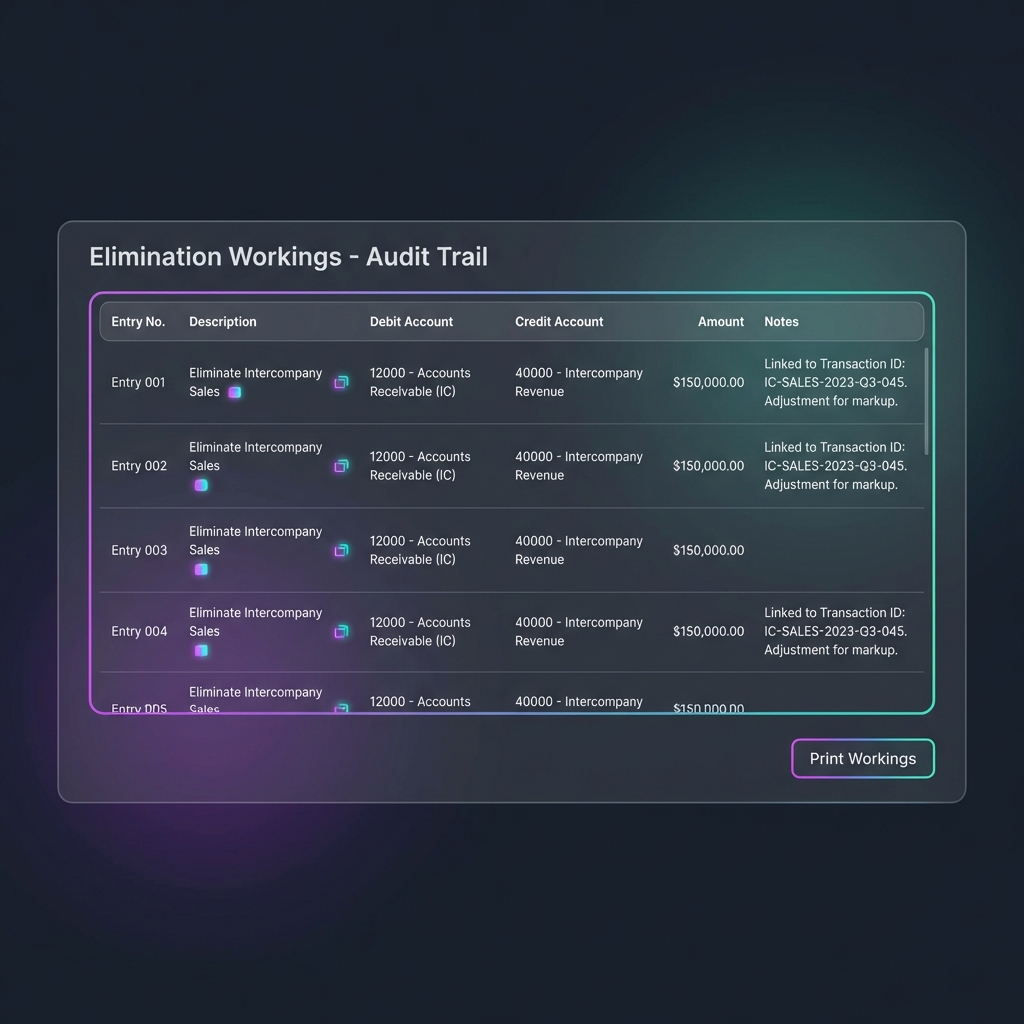

Elimination Workings — Full Audit Trail

Every elimination entry is logged with full details for audit purposes. Each entry links back to the original intercompany transaction with notes and descriptions.